How AI Analytics Improves Forecasting and Planning

Business Intelligence

Feb 4, 2026

How AI analytics boosts forecast accuracy, speeds planning cycles, and optimizes inventory and staffing with live data and governed metrics.

AI analytics is transforming how businesses forecast and plan. By replacing error-prone spreadsheets and manual processes with advanced tools, companies can predict trends, allocate resources effectively, and make faster decisions. Here’s what you need to know:

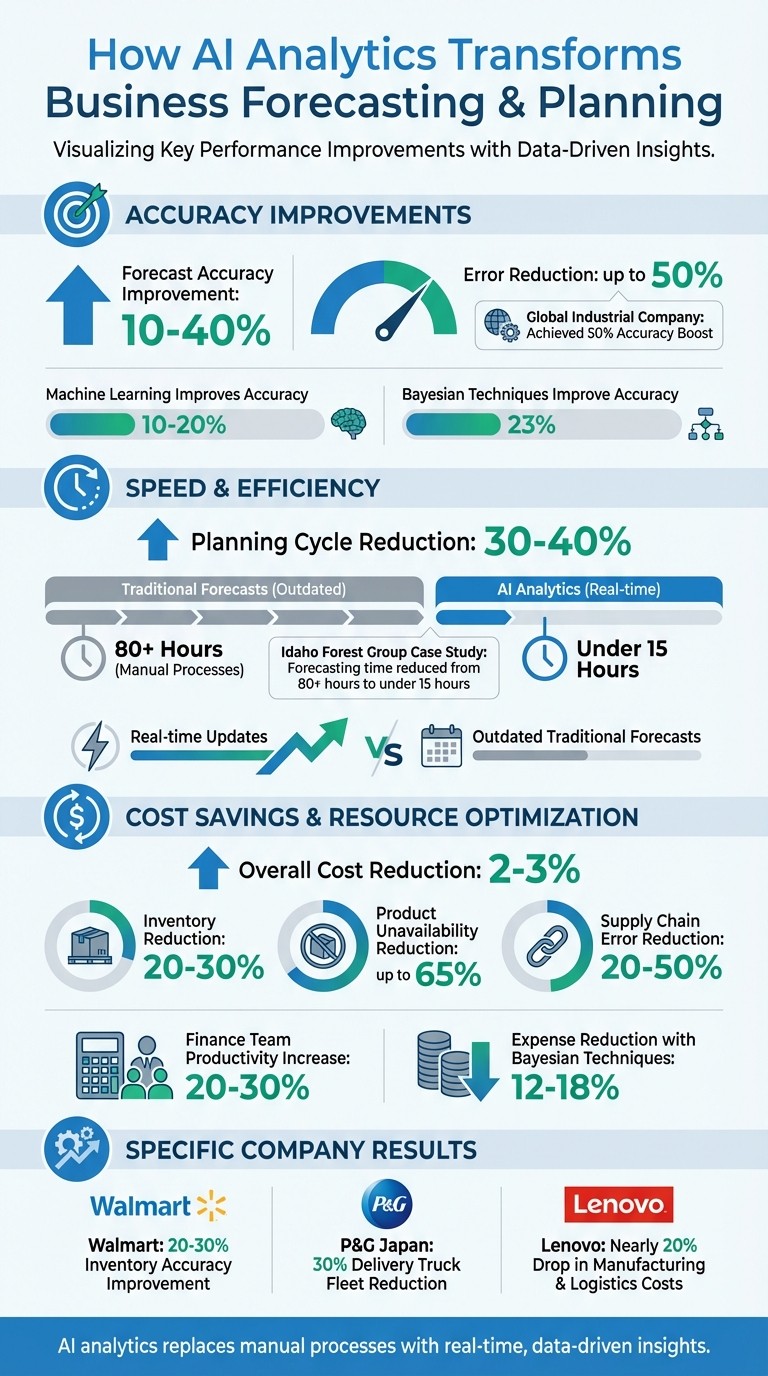

Accuracy Boost: AI improves forecast accuracy by 10-40% and reduces errors by up to 50%.

Speed: Planning cycles are cut by 30-40%, saving time for strategic decisions.

Cost Savings: Companies report a 2-3% drop in costs and a 20-30% reduction in inventories.

Real-Time Insights: AI updates forecasts instantly with new data, ensuring plans stay relevant.

Resource Optimization: From inventory to staffing, AI ensures efficient operations.

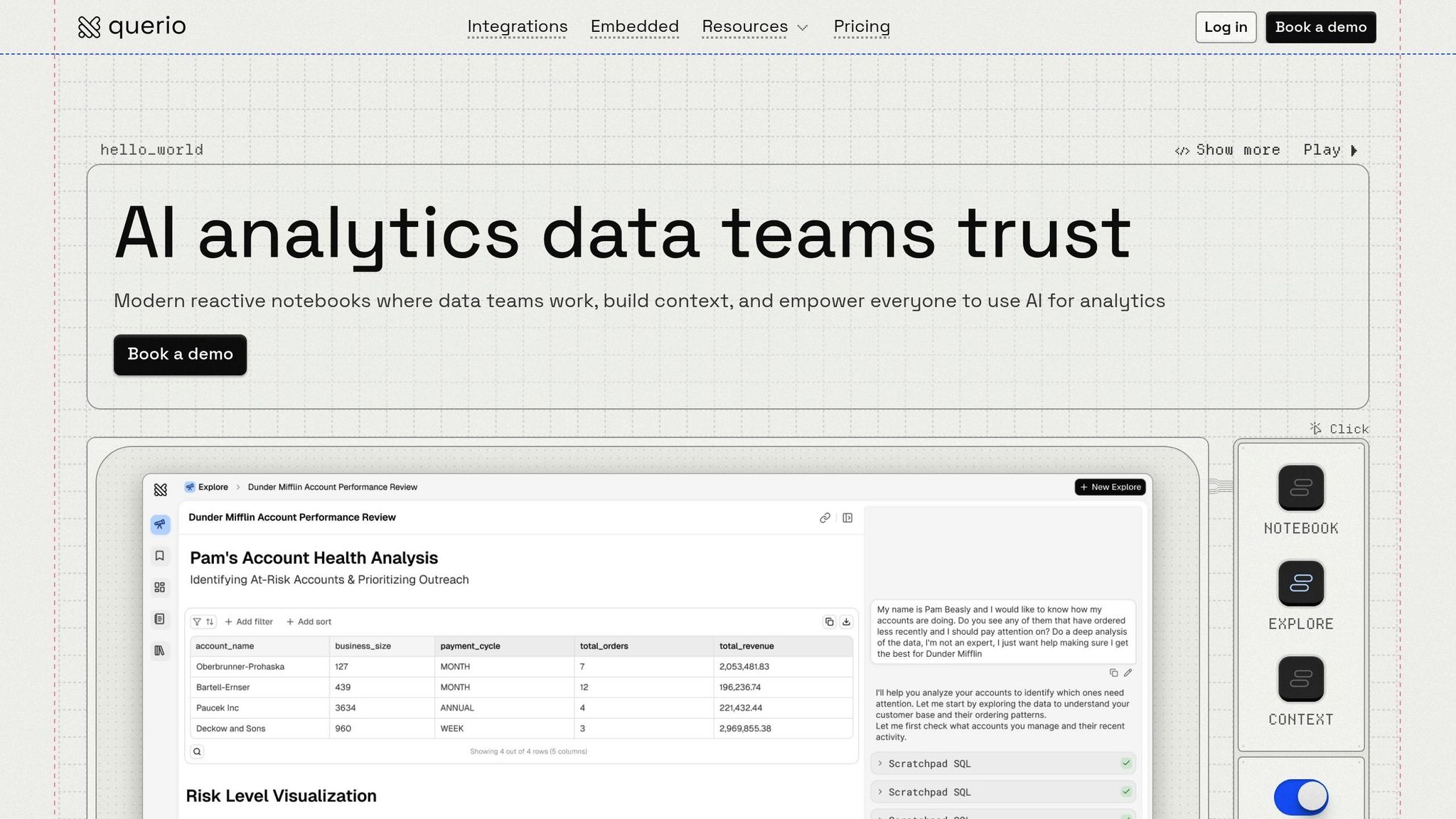

AI isn’t just a tool - it’s reshaping business intelligence. Tools like Querio provide live data connections, natural language queries, and consistent metrics, empowering teams to make smarter decisions with confidence.

AI Analytics Impact on Business Forecasting: Key Performance Metrics

Forecast Forward: Optimizing Business Planning with AI-Driven Scenario Forecasting

Main Benefits of AI Analytics for Forecasting and Planning

AI analytics brings three standout advantages to forecasting and planning: sharper accuracy, adaptability in real-time, and smarter resource management. These capabilities directly lead to measurable improvements across business operations. Here's how AI transforms forecasting into a powerful tool for decision-making.

Better Prediction Accuracy with AI

AI has a knack for uncovering patterns that traditional methods, and even spreadsheets, often miss. Instead of relying on averages or fixed growth rates, AI dives deep into complex, non-linear relationships among key factors [8]. Businesses using AI for forecasting report improvements of 20% to 40% in accuracy [7]. For instance, a global industrial goods company revamped its forecasting process with an AI/ML system, achieving a 50% boost in accuracy [7].

What sets AI apart is its ability to provide probability ranges and confidence intervals, giving leaders a nuanced view of risks - both potential gains and losses - rather than just a single, static forecast [8][2]. By automating data preparation and model selection, AI also frees up teams to focus on interpreting results and making strategic decisions instead of getting bogged down in manual calculations.

Real-Time Updates with Changing Data

Traditional forecasting methods often take so long to complete that plans are outdated by the time they're ready. AI, on the other hand, keeps pace with new data, continuously retraining and adjusting its models to reflect the latest trends [8][10]. It processes vast amounts of real-time external data - like weather patterns, social media activity, shipping movements, and spending habits - to detect market changes weeks ahead of official reports [5][10].

A great example is Whataburger, which operates over 900 locations and generates $3 billion in revenue. By integrating external data and predictive analytics through Board Foresight, their Financial Planning & Analysis team, led by Director Pete Valadez, could incorporate real-time alerts and market signals into their forecasts. This approach significantly improved accuracy and helped them avoid falling short of expectations [5].

"By incorporating external data and predictive analytics into our forecasting process, we've been able to dramatically improve our accuracy and avoid missed expectations."

– Pete Valadez, Director of Financial Planning & Analysis, Whataburger [5]

AI tools also speed up planning cycles by 30% to 40% [6], allowing businesses to run "what-if" scenarios and simulations in just minutes [5][6]. During the COVID-19 pandemic, Milwaukee Tool used Board Foresight to analyze macroeconomic trends and their impact on product categories. This helped their supply chain team, led by VP Brad Sayers, validate plans and guide investments during a volatile period [5].

Efficient Resource Allocation and Operations

AI isn't just about better predictions - it also revolutionizes resource management. By analyzing external demand signals like weather trends, social media data, and economic shifts, AI helps businesses optimize inventory levels, cut carrying costs, and reduce warehouse space needs [11][14]. For example, Walmart improved its inventory accuracy by 20% to 30% with AI forecasting, while other companies reported inventory reductions of 20% to 30% and supply chain error reductions of 20% to 50% [10][11][12][14].

The impact goes beyond inventory. AI-powered forecasting can reduce product unavailability by up to 65% [11][14]. P&G Japan leveraged AI to cut its delivery truck fleet by 30% [13], while Lenovo reported a nearly 20% drop in manufacturing and logistics costs thanks to AI-driven supply chain insights [13].

AI also enhances workforce planning. In industries like healthcare and hospitality, AI predicts busy periods, enabling better staffing alignment with actual demand. In manufacturing, it identifies equipment failure patterns, triggering proactive repairs to prevent downtime. Even in finance, AI boosts productivity by 20% to 30%, freeing teams to focus on strategic projects instead of manual data entry [7].

AI Techniques Used in Forecasting and Planning

Several AI techniques have reshaped forecasting and planning, delivering measurable improvements. Among the most impactful are machine learning for uncovering hidden patterns, AutoML for making advanced modeling accessible to non-experts, and Bayesian networks for tackling uncertainty. Each plays a unique role in addressing key challenges in forecasting workflows.

Machine Learning for Pattern Recognition

Machine learning shines in identifying patterns that traditional methods might miss. By processing raw data, ML algorithms generate features that reflect factors like seasonality, promotions, pricing strategies, and broader economic trends [8]. For instance, these models can capture complex relationships, such as how weather conditions influence demand during promotional periods [8] [10].

What sets machine learning apart is its ability to combine internal data (e.g., sales figures, marketing performance) with external sources (e.g., competitor activities, demographic trends, or social media sentiment) to pinpoint demand drivers [9] [10]. Additionally, advanced AI tools help clean historical data by detecting and addressing anomalies or outliers that could distort traditional forecasting methods [1]. The result? Forecast accuracy improves by 10% to 20%, while errors are reduced by 20% to 50% [15] [9] [10].

"AI's strength lies in its ability to crunch massive amounts of data rapidly, so that human demand forecasting specialists can focus on interpreting and communicating the results." – Margaret Lindquist, Senior Writer, Oracle [10]

Building on ML's ability to uncover patterns, AutoML makes it easier for teams to develop predictive models.

AutoML for Simplified Model Building

Automated Machine Learning (AutoML) eliminates many technical hurdles, enabling teams without deep data science expertise to build effective models. AutoML handles tasks like data preparation, model selection, and hyperparameter tuning, using algorithms such as ARIMA, Prophet, XGBoost, and LightGBM [17] [9] [3].

For example, Idaho Forest Group managed to cut its forecasting time from over 80 hours to under 15 hours [1]. By automating these time-consuming steps, AutoML frees up finance and planning teams to focus on strategic decisions rather than technical details. This allows for faster planning cycles and more accurate predictions, as highlighted earlier.

With these streamlined processes in place, Bayesian networks take forecasting to the next level by addressing uncertainty and risk.

Bayesian Networks for Risk Assessment

Bayesian techniques use probabilistic models to evaluate uncertainty, making them ideal for complex planning scenarios [18] [19]. Unlike single-point forecasts, Bayesian methods explore both unknown data and proven solutions, enabling "what-if" simulations to model demand fluctuations or supply chain disruptions [18] [13] [4].

These models continuously refine their strategies as new data becomes available, improving optimization over time [18] [20]. For example, organizations using Bayesian techniques have seen forecast accuracy improve by 23% [19]. By quantifying risk and identifying non-linear relationships, these methods help businesses move from reactive planning to proactive decision-making. This shift often leads to expense reductions of 12% to 18% [19], ensuring resources are allocated efficiently.

"Now with AI solutions, everything from integrating the information into the system, cleaning the information, then preparing the information for forecast, then running the [Anaplan Intelligence] statistical models at scale of our 300 million data rows - this is incredible!" – Dany Krivoshey, Chief Digital and Transformation Officer, Unilever International Group [4]

How Querio Improves Forecasting and Planning

Querio brings together advanced AI tools in a single analytics workspace that directly connects to your data warehouse. This setup allows planning and finance teams to work with live data, create forecasts using natural language queries, and maintain strict data governance.

Here’s how Querio’s live connections, semantic layer, and interactive dashboards come together to enhance forecasting and planning.

Live Connections to Your Data Warehouse

Querio integrates seamlessly with Snowflake, BigQuery, Amazon Redshift, ClickHouse, and PostgreSQL. This direct connection enables live forecasting without the hassle of duplicating data. When market conditions shift or new sales data comes in, your forecasts update automatically - no need for manual exports or lengthy batch processes.

This approach eliminates the delays common in traditional BI workflows. While conventional tools might take days or even weeks to deliver updated insights, Querio provides answers in seconds or minutes by tapping directly into your data. Teams can ask straightforward questions like, “What’s our projected Q2 revenue based on current pipeline trends?” and instantly get SQL-generated results they can verify.

Governed Semantic Layer for Consistent Metrics

Accurate forecasting hinges on having consistent definitions across the organization. Querio’s shared semantic layer allows data teams to define joins, metrics, and business terminology once and apply them universally. This eliminates the inconsistencies that arise when different departments calculate metrics like "monthly recurring revenue" or "customer lifetime value" in varying ways.

With this centralized logic, whether you're building a demand forecast or analyzing KPIs, the calculations remain the same. This approach replaces the fragmented metrics often found in traditional BI tools, where logic is scattered across multiple reports and spreadsheets.

Once consistent metrics are established, Querio enhances their utility through dynamic dashboards and iterative scenario planning.

Dashboards and AI-Powered Insights

Querio turns analysis into interactive dashboards and scheduled reports. AI agents convert natural language queries into SQL and Python code, delivering results that are fully inspectable. This transparency is critical for forecasting, as finance teams need to understand not just what a model predicts but also why it predicts a particular outcome.

The platform’s interactive notebook environment allows teams to experiment with different assumptions, rerun models, and compare forecasts side-by-side. This iterative approach improves forecast accuracy and supports better strategic decision-making. With 70% of businesses now viewing real-time analytics as essential to their operations [2], Querio’s blend of live data connections and AI-driven insights helps organizations respond swiftly to market changes while upholding the governance needed for financial planning.

Practical Applications of AI Analytics in Business Intelligence

AI analytics transforms predictions into actionable strategies, enabling businesses to anticipate customer needs, manage risks, and streamline operations.

Demand Forecasting for E-Commerce

E-commerce businesses face a constant balancing act: having too much inventory ties up funds and increases storage costs, while running out of stock can mean missed sales and unhappy customers. Querio's live data warehouse connections help solve this challenge. For example, merchandising teams can ask, "What will the demand for winter apparel in the Northeast look like in December 2026?" The system responds with SQL-driven forecasts that combine current sales trends, seasonal patterns, and regional preferences.

The platform’s natural language interface makes it easy for inventory managers to adjust forecasts as new data comes in - whether it’s a sudden weather shift, a viral social media trend, or price changes. Querio’s governed semantic layer ensures consistent calculations of metrics like "sell-through rate" and "inventory turnover", so teams across merchandising, finance, and supply chain are always aligned.

Just as e-commerce relies on precise inventory management, fintech thrives on equally meticulous forecasting.

Financial Risk Mitigation in Fintech

In fintech, where the stakes are high, accurate risk assessment is non-negotiable. Tasks like credit risk analysis, fraud detection, and portfolio management depend on analyzing intricate, fast-changing datasets. Querio’s AI agents turn queries about default probabilities, transaction anomalies, or market volatility into inspectable SQL and Python code, making it easier for risk analysts to validate and refine their findings.

Transparency is especially critical in this field. When a flagged transaction is marked as fraudulent or a credit score changes, compliance teams must understand the reasoning behind these decisions. Querio’s notebook environment supports this need, allowing analysts to tweak risk parameters, compare model outputs, and document their logic for auditors. This blend of AI-driven insights and human oversight helps fintech companies address emerging risks while meeting regulatory standards.

AI analytics isn’t just about forecasting - it also drives smarter operations.

Optimizing Resource Allocation and Operations

Manufacturing and logistics companies rely on AI analytics to improve production schedules, plan maintenance, and optimize delivery routes. Organizations using AI across their operations report higher returns compared to those sticking with traditional methods [16]. Querio’s natural language interface empowers warehouse managers and production supervisors to explore complex datasets without needing help from data teams.

For example, a logistics coordinator might ask, "Which delivery routes had the most delays last month?" Meanwhile, a plant manager could query, "What’s the predicted equipment downtime for Q2 based on current maintenance schedules?" Querio’s semantic layer ensures that metrics like "production yield" or "on-time delivery rate" are calculated consistently across departments. With live connections and interactive dashboards, teams can test predictive maintenance strategies or optimize routes, proving their value quickly before scaling these solutions across the organization [16].

Conclusion

AI analytics takes forecasting to a whole new level, replacing guesswork with precise, data-driven insights. This allows organizations to predict market trends, allocate resources effectively, and react in real time. The real game-changer isn’t just the speed - it’s the ability to work with live data, clear logic, and insights that teams can rely on. Tools like Querio make this transformation even more accessible.

Querio simplifies the complexity of forecasting by combining advanced technology with user-friendly features. Its natural language interface allows anyone to ask questions in plain English, while analysts can review and adjust the automatically generated SQL or Python code. With live data connectivity, outdated reports become a thing of the past, and its governed semantic layer ensures consistent metrics across teams.

For teams aiming to excel, the ability to turn questions into actionable insights in minutes is a significant advantage. Whether it’s predicting holiday season demand, evaluating credit risks, or fine-tuning delivery routes, Querio’s AI-driven capabilities make complex data easy to understand and use. This empowers both business users and data experts to achieve accuracy and efficiency.

In fast-changing markets, success depends on the ability to adjust quickly and confidently. Querio combines automation with reliable and consistent data management, giving businesses the tools they need to stay agile and effective.

FAQs

How does AI analytics make forecasting more accurate than traditional methods?

AI analytics takes forecasting to a whole new level by uncovering complex data patterns and responding to real-time changes far more effectively than traditional methods. Conventional tools, like spreadsheets or basic models, often fall short in volatile markets, typically achieving accuracy rates between 70–79%. In contrast, AI-powered solutions can boost accuracy to an impressive 85–95% in demand forecasting.

This leap in precision happens because AI can process massive, intricate datasets, spot subtle trends, and adapt dynamically as conditions change. With AI, businesses gain the ability to make more accurate predictions, anticipate market fluctuations, and fine-tune their planning strategies. The result? Smarter resource allocation and streamlined operations that help organizations maintain a competitive edge.

What are the key advantages of using real-time data in AI forecasting?

Using real-time data in AI forecasting brings several clear benefits. By continuously updating with the latest information, businesses can produce more precise and timely predictions, allowing them to react quickly to market changes, supply chain issues, or shifts in customer behavior. This approach enables organizations to make well-informed, data-driven decisions with confidence.

Another advantage is the speed it brings to forecasting. Instead of taking days or even weeks to analyze data and produce insights, real-time updates can cut that down to just minutes. This quick turnaround helps businesses stay agile and maintain their competitive position. Additionally, real-time integration can highlight emerging patterns or anomalies that static models might overlook, improving the ability to spot trends and allocate resources more effectively.

In essence, real-time data boosts accuracy, efficiency, and flexibility, giving businesses the tools they need to navigate rapidly changing environments.

How does AI analytics help businesses allocate resources more effectively?

AI analytics enables businesses to use predictive models to analyze both historical and real-time data, helping them allocate resources more effectively. These models offer precise forecasts of future demand, which allows organizations to distribute resources wisely and avoid issues like overstocking or shortages. For example, companies can optimize inventory levels, staffing schedules, or infrastructure needs based on expected demand, cutting down on waste and controlling costs.

On top of that, AI-powered systems support real-time adjustments by continuously monitoring operational data. This allows businesses to fine-tune resource allocation on the fly, ensuring that resources are directed to the right place at the right time. This dynamic approach not only boosts performance but also helps avoid unnecessary spending. With AI-driven insights, businesses can make smarter, proactive decisions that improve overall efficiency.