Ultimate Guide to eCommerce KPI Benchmarking Models

Business Intelligence

Jan 18, 2026

Explore essential eCommerce KPIs, benchmarking models, and AI tools to enhance performance and drive growth in a competitive market.

KPI benchmarking is a must for eCommerce businesses aiming to improve performance. It involves comparing your metrics - like conversion rates, average order value (AOV), or cart abandonment rates - against industry standards, competitors, or your own historical data. This process helps identify strengths, spot weak areas, and set realistic goals.

Key takeaways:

Conversion Rates: Average 2.5%-3.5%, with top performers exceeding 5%.

AOV: Typically $50-$150 depending on the category.

Cart Abandonment Rate: Industry average is 70%, with top businesses keeping it under 60%.

CLV: Varies widely, often $150-$500 for direct-to-consumer brands.

AI tools like Querio simplify benchmarking by offering instant insights through natural-language queries, reducing analysis time from weeks to minutes. These tools also ensure data accuracy and accessibility, making it easier for teams to act on insights. Whether you're tracking internal trends, comparing competitors, or aiming for best-in-class performance, benchmarking is a powerful way to stay competitive in the fast-paced eCommerce environment.

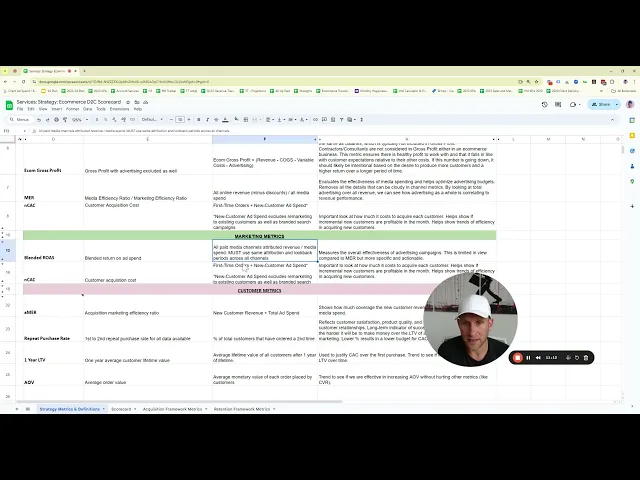

The Ultimate Ecommerce D2C KPI Scorecard

Key eCommerce KPIs and Their Benchmarks

When it comes to measuring success in eCommerce, identifying the right metrics is crucial, and tools that let you chat with Snowflake, BigQuery, or Redshift make accessing those insights easier. By focusing on key performance indicators (KPIs) and comparing them to industry standards, businesses can set targets that drive growth. Missing the mark on these metrics could mean losing out on significant revenue opportunities.

Core KPIs for eCommerce

Some of the most important KPIs in eCommerce include conversion rate, average order value (AOV), customer lifetime value (CLV), cart abandonment rate, and gross merchandise value (GMV). Let’s break these down:

Conversion Rate: This metric, calculated as (Conversions ÷ Visitors) × 100, reveals how well your site turns visitors into customers. A higher conversion rate directly boosts revenue. Using an AI data analytics copilot can help teams identify the specific friction points causing these drops.

Average Order Value (AOV): AOV, figured as Revenue ÷ Number of Orders, shows how much customers typically spend in each transaction. It’s a great metric for spotting upselling opportunities.

Customer Lifetime Value (CLV): CLV estimates the total profit a customer generates over their entire relationship with your business. The formula is (Customer Profit × Lifespan) – Acquisition Cost. It’s key for assessing long-term profitability and justifying marketing spend.

Cart Abandonment Rate: This metric highlights the percentage of shoppers who leave without completing a purchase. It’s calculated as 1 – (Transactions ÷ Shopping Carts) × 100. A high abandonment rate often points to issues in the checkout process.

Gross Merchandise Value (GMV): GMV measures the total value of sales before accounting for returns, discounts, or fees. While it doesn’t reflect net revenue, it’s a solid indicator of overall sales volume.

Benchmark Ranges for Key Metrics

Benchmarks vary across industries and sales channels, but here’s a general idea of where your business might stand:

Conversion Rates: Most eCommerce sites see rates between 2.5% and 3.5%. Top performers can hit 5% or more. Apparel averages around 2.5%, while beauty brands often reach 3.5% due to impulse buying and lower price points.

Average Order Value (AOV): AOV ranges from $50 to $150 depending on the product category. Fashion typically averages $75, electronics often exceed $120, and luxury brands can see AOVs of $200 or more.

Customer Lifetime Value (CLV): CLV varies widely. Direct-to-consumer brands often fall between $150 and $500, while subscription models can exceed $1,000. Marketplace sellers generally see lower CLVs due to reduced brand loyalty.

Cart Abandonment Rates: These tend to hover around 70% industry-wide. Luxury goods often exceed 80% due to higher price points, while mobile devices show higher abandonment rates compared to desktops.

Sales channels also play a big role. Direct-to-consumer (DTC) brands often report higher AOVs and CLVs thanks to loyalty programs and stronger customer relationships, but they may struggle with lower conversion rates compared to marketplaces like Amazon. Platforms like Amazon, on the other hand, often boast conversion rates of 10% or more due to streamlined shopping experiences, though their AOVs are typically lower due to competitive pricing.

KPI | DTC Brands | Marketplaces | Industry Average |

|---|---|---|---|

Conversion Rate | 2.5% - 3.5% | 10%+ | 2.86% |

Average Order Value | $70 - $120 | $50 - $80 | $80 |

Cart Abandonment Rate | 68% - 75% | 60% - 70% | 70% |

Customer Lifetime Value | $150 - $500+ | $100 - $300 | $150 |

These numbers are a starting point. Seasonal trends, product categories, and device types can all influence your performance.

Factors That Affect KPI Benchmarks

Several factors can significantly impact eCommerce KPIs, making it essential to account for them when setting benchmarks:

Seasonality: Metrics like conversion rates and AOV often spike during the holiday season, with increases of 30-50%. Black Friday and Cyber Monday are peak times but may also lead to higher cart abandonment due to inventory shortages or overwhelming traffic.

Regional Trends: Urban areas in the U.S. generally report higher conversion rates and AOVs due to higher purchasing power and greater adoption of online shopping. Coastal regions often outperform inland areas for similar reasons.

Product Categories: High-ticket items like electronics or furniture naturally have lower conversion rates but higher AOVs. Meanwhile, consumables and beauty products tend to see higher conversion rates due to repeat purchases and brand loyalty.

Device and Traffic Source: Mobile commerce continues to grow, but mobile conversion rates often lag behind desktop by 1-2 percentage points. Social media traffic typically converts less but drives higher engagement, while email marketing tends to yield above-average conversion rates thanks to existing customer relationships.

Types of KPI Benchmarking Models

Selecting the right benchmarking approach can provide insights that directly inform your strategies. Each model comes with its own purpose, strengths, and challenges, offering a unique way to evaluate and improve performance. In the fast-moving world of eCommerce, these models help businesses keep pace with change while staying focused on growth.

Internal Benchmarking

Internal benchmarking involves comparing your current performance metrics with your own historical data or evaluating different departments or business units within your organization[2][5]. This method is particularly useful for establishing baseline metrics and tracking progress toward your specific goals, without relying on external data.

For example, you might monitor month-over-month shifts in conversion rates or compare performance across channels, such as your mobile app versus your desktop website. You could also identify which product categories contribute the highest average order values[4]. These comparisons allow you to directly link performance changes to initiatives like marketing campaigns, website updates, or inventory adjustments[2].

Since you control all the data, internal benchmarking is both accessible and straightforward. However, it does have its downsides. You might see consistent improvement internally but still lag behind competitors or industry norms. External factors like seasonal trends, market disruptions, or unique events can also skew your internal comparisons. Additionally, this method won't reveal whether the entire industry is facing similar challenges. Internal benchmarking serves as the foundation for broader comparisons.

Competitive and Industry Benchmarking

Once you've identified internal trends, comparing your performance against external benchmarks can reveal how you stack up in the market. Competitive benchmarking focuses on comparing your KPIs with those of specific competitors, while industry benchmarking uses broader market data and averages across your sector[3][4].

Competitive benchmarking is especially relevant because it evaluates your performance against businesses with similar models, target audiences, and market conditions. For example, an online fashion retailer might analyze metrics like average order value, cart abandonment rates, and customer acquisition costs to pinpoint gaps compared to their direct competitors.

Industry benchmarking, on the other hand, provides a more general perspective. By looking at sector-wide averages, you can determine whether your performance meets or exceeds market expectations.

Both approaches offer valuable context for setting realistic improvement goals. However, challenges like limited access to competitor data, inconsistent measurement methods, and a lack of operational context can make these comparisons tricky. Still, they’re essential for identifying where you stand and where you can improve.

Best-in-Class Benchmarking

Best-in-class benchmarking takes it a step further by comparing your performance to the top companies in your industry, regardless of whether they’re direct competitors[2][5]. Instead of focusing on averages, this model looks at the leaders who excel in areas like customer retention, marketing, or operational efficiency.

For instance, you might study companies achieving repeat purchase rates of 30–40%, compared to the typical range of 15–30%[4]. This approach helps you uncover best practices, understand what it takes to achieve top-tier results, and set ambitious goals for your business.

However, this model isn’t without its challenges. Best-in-class companies often benefit from factors like brand recognition, market timing, or financial resources that may not be replicable. This can make their performance targets feel out of reach. Additionally, survivorship bias - focusing only on successful companies - can skew your perspective.

Model Type | Data Source | Best For | Main Limitation |

|---|---|---|---|

Internal | Your own historical data | Tracking improvement trends | May miss broader market context |

Competitive | Direct competitor data | Understanding market position | Limited data access |

Industry | Sector-wide averages | Setting realistic targets | May not fit your business model |

Best-in-Class | Top performer data | Setting aspirational goals | May be unrealistic to achieve |

Successful eCommerce businesses often combine these models. Internal benchmarking helps track personal trends, while industry benchmarks set baseline expectations. Competitive benchmarking offers tactical insights, and best-in-class benchmarking inspires long-term strategic goals. Together, they provide a well-rounded view of performance and opportunities for growth.

Using Querio for AI-Powered KPI Benchmarking

In the ever-changing world of eCommerce, staying ahead requires more than just raw data - it demands actionable insights. Enter Querio, an AI platform that simplifies benchmarking by delivering performance data directly to your team. Unlike traditional benchmarking, which can be slow and complicated, Querio streamlines the process, making it accessible and efficient for everyone.

Natural-Language Queries for Benchmarking

Querio's standout feature is its ability to transform everyday questions into immediate, clear insights. Forget waiting on data analysts to craft complex queries. With Querio, you can simply ask, "What was last month's cart abandonment rate compared to industry standards?" and get a chart with the answers in seconds[2][3].

Here’s how it works: Querio securely connects to your US-based data sources in real time. When you pose a question, the platform’s natural-language agent translates it into SQL, queries your database, and delivers polished visualizations - all behind the scenes.

For example, a retail manager recently asked, "What were our top 5 selling products last month?" Querio instantly processed the question, generated the SQL, ran the query, and presented a clean bar chart showing the top products and their sales figures[7]. This same capability extends to benchmarking, letting you easily compare metrics like conversion rates or average order values against historical data or industry benchmarks - no technical expertise required.

The platform’s core plan includes 4,000 monthly prompts, giving teams plenty of room to explore performance metrics, test various time frames, and analyze different scenarios without worrying about hitting a ceiling. Whether you’re diving into KPI trends or experimenting with new benchmarking ideas, Querio makes it easy to dig deeper.

On top of instant answers, Querio provides custom dashboards tailored to each team’s specific needs.

Custom Dashboards and Metrics Management

Querio doesn’t stop at quick answers - it also organizes your KPI data into detailed dashboards for every department. Marketing teams can focus on metrics like conversion rates, ROAS, and CAC, while finance teams monitor gross margins and customer acquisition costs. Meanwhile, product managers can track user engagement and feature adoption rates - all in one place[2][3].

The platform ensures consistency across these dashboards with built-in governance features. Data teams can define metrics, joins, and glossaries once, and these standardized definitions automatically apply to all AI-generated insights[7]. This means that when your marketing team looks up "Customer Lifetime Value" and your finance team does the same, both will see identical calculations based on your organization’s agreed-upon definition.

For example, if your company defines "cart abandonment rate" as customers who add items to their cart but fail to check out within 24 hours, this definition will remain consistent across every dashboard and query, no matter who’s asking.

Querio also supports automated reporting, ensuring executives stay informed without manual updates. Plus, its embedded analytics capabilities allow you to integrate dashboards directly into existing platforms or customer portals. This means store managers or external partners can access real-time benchmarking insights seamlessly, without leaving their workflow.

Data Integration and Compliance

Querio takes data security seriously. Its read-only connections ensure your sensitive information remains protected, and the platform holds SOC 2 Type II certification, meeting strict US data security standards[7].

Your purchase histories, inventory levels, and financial metrics stay within your infrastructure while remaining accessible for AI-driven analysis. Querio also adheres to US localization standards, displaying currency in dollars ($), using MM/DD/YYYY date formats, and applying standard US number formatting with commas for thousands and periods for decimals.

Setting up Querio is straightforward. It involves secure authentication and configuration of your existing data sources, so there’s no need for data migration or duplication. This approach means you can begin benchmarking your KPIs against historical performance or industry standards within days - not months.

"It's not just about saving time and money, it's about making data accessible." – Mohamad Ali Baydoun, CTO @LemonadeFashion

Querio is also expanding its capabilities. The upcoming Python notebooks feature will allow for deeper analysis while maintaining the same high standards of security and compliance. This addition positions Querio as a flexible solution that evolves with your benchmarking needs, from simple KPI comparisons to advanced predictive modeling.

For instance, a subscription box company integrated Querio with their Snowflake data warehouse to track customer lifetime value and optimize marketing spend, achieving a 10% boost in retention[2][3]. Similarly, an online retailer used Querio to monitor cart abandonment rates against industry benchmarks, leading to targeted interventions that reduced abandonment by 15% in just one quarter.

Best Practices for eCommerce KPI Benchmarking

KPI benchmarking isn't just about tracking numbers; it's about using those numbers strategically to align with your business goals, build a solid data foundation, and foster a culture where teams actively use insights to improve performance. When done right, it turns static dashboards into actionable tools that drive results.

Selecting the Right KPIs

Choosing the right KPIs is the first step in effective benchmarking. Your metrics should directly tie to your business objectives and focus on outcomes that matter most.

Start by identifying your primary business goals. For growth, you might look at customer acquisition cost (CAC), conversion rates, and average order value (AOV). If retention is your focus, metrics like customer lifetime value (CLV), repeat purchase rates, and churn rates become essential. The type of business you run also plays a role. For example, a direct-to-consumer apparel brand should monitor conversion rates, AOV, and return rates, while a B2B wholesaler might prioritize order frequency and CLV [2][3][4].

Industry benchmarks provide useful context. Research what’s typical in your sector to set realistic goals. For instance, if the average conversion rate in your industry is 3.0% and you’re at 2.5%, aiming for 2.8% offers a realistic and motivating target [4][5]. Collaborate with cross-functional teams to identify metrics that align with their responsibilities and priorities.

To ensure your KPIs are actionable, apply the SMART framework - Specific, Measurable, Achievable, Relevant, and Time-bound. This keeps your metrics focused and practical. Revisit your KPIs regularly, especially during quarterly reviews or when major strategic shifts occur, to ensure they remain aligned with evolving business needs [4][6].

Once you’ve selected the right KPIs, the next step is making sure your data systems can support them effectively.

Building Reliable Data Systems

Your benchmarks are only as strong as the data supporting them. A reliable data foundation ensures everyone works from the same baseline, eliminating confusion caused by conflicting reports.

Good data governance can improve data quality by as much as 30% [1]. Start by integrating all your data sources - eCommerce platforms, CRMs, advertising accounts, and financial systems - into a unified system. This creates a single source of truth, reducing discrepancies and reinforcing the accuracy of your benchmarks.

Automating data collection is key to avoiding manual errors and maintaining consistency. Regularly validate your data to catch issues early, such as reconciling order data between your eCommerce platform and financial systems. Assign clear data ownership within your team, so specific individuals are responsible for maintaining data quality in their areas.

A unified data system can cut data reconciliation time by 50%, allowing teams to focus on analysis and action. Schedule monthly reviews of key data sources and quarterly checks of your overall data architecture. Automated error detection tools can flag unusual patterns or missing data before they affect your benchmarks.

Platforms like Querio simplify this process by connecting directly to your data warehouses while ensuring strict data security through features like read-only connections and SOC 2 Type II certification. These tools help maintain consistency and make data accessible across teams [7].

With a reliable data foundation in place, the next step is ensuring your teams are aligned and actively using the insights.

Aligning Teams with Benchmarking Data

Even the best benchmarking systems fall short if teams don’t engage with the data. Alignment requires accessible tools and a culture that values data-driven decisions.

Host regular cross-functional meetings to review KPI performance. These sessions should be collaborative, encouraging teams to ask questions, share insights, and propose solutions based on the data. Avoid turning these into mere reporting sessions - engagement is key.

Provide custom dashboards tailored to each team’s needs. For example, marketing teams need visibility into conversion funnels and campaign performance, while operations teams focus on metrics like inventory turnover and fulfillment rates. Consistent metric definitions across dashboards prevent confusion during cross-team collaborations.

Invest in data literacy training to empower employees at all levels. When team members understand how to interpret KPI data, they can make better decisions and contribute more effectively to improving performance. Tools like Querio, with its natural-language interface, make data accessible even for non-technical users.

Establish clear protocols for acting on insights. For example, if benchmarking reveals a gap in conversion rates, predefined processes could include investigating checkout friction, optimizing page load speeds, or enhancing product displays. Document these actions and measure their impact to build a knowledge base of what works for your business.

Regular benchmark reviews should lead to specific actions. If your conversion rate consistently underperforms against industry standards, dig into potential causes and address them systematically. Whether through A/B testing, adjusting marketing spend, or refining product offerings, the goal is to create a feedback loop where insights drive actions, and actions generate new data for further evaluation.

This continuous improvement cycle, supported by reliable data and engaged teams, transforms KPI benchmarking from a routine exercise into a powerful tool for gaining a competitive edge.

Conclusion

KPI benchmarking takes eCommerce from reactive guesswork to a proactive, data-driven strategy that helps businesses stay ahead in a competitive market. Leading online retailers make it a priority to track critical metrics like conversion rates, customer acquisition costs, and lifetime value. Why? These numbers pinpoint both opportunities to seize and challenges to address.

The emergence of AI-powered analytics tools like Querio is breaking down data barriers. These platforms provide instant, governed visualizations that allow teams to act quickly when market conditions shift. For example, if your team notices a cart abandonment rate of 68% compared to a 70% benchmark, they can address the issue on the spot [4].

Access to real-time data offers a crucial advantage. It enables businesses to identify trends and adjust strategies on the fly, whether during a busy holiday season, a promotional push, or while testing new products. This agility can make a big difference in achieving better outcomes.

Successful eCommerce brands weave KPI tracking into their daily workflows, empower teams with user-friendly analytics tools, and foster a culture where decisions are firmly rooted in data. Whether you're keeping an eye on daily campaign results, monthly retention figures, or quarterly growth targets, consistent benchmarking creates a feedback loop that turns insights into measurable progress.

To get started, focus on integrating your data, standardizing KPI definitions, and adopting analytics tools that are easy for your team to use. By doing so, you'll unlock higher conversion rates, improved customer retention, and more efficient marketing spend. The real question isn't whether to embrace KPI benchmarking - it’s how quickly you can leverage it to gain a competitive edge. Start today and transform insights into actionable results for your business.

FAQs

How can eCommerce businesses use AI tools like Querio to enhance their KPI benchmarking?

eCommerce businesses can use Querio to simplify KPI benchmarking by making data access and analysis straightforward. With Querio, users can ask questions in plain English and receive instant, clear visualizations. This approach makes even the most complex data easy to understand, whether you're an executive or part of the team.

Querio connects directly to data sources like Snowflake, BigQuery, and Postgres, eliminating the need for duplicate data storage. Its natural-language processing turns plain English queries into SQL commands, providing results in seconds. This allows businesses to keep track of essential metrics, spot trends, and make quicker, informed decisions.

What are the main differences between internal, competitive, and best-in-class benchmarking models, and how can businesses choose the right one?

Internal benchmarking involves evaluating performance metrics within your organization - like comparing departments or tracking changes over time - to pinpoint areas that need improvement. Competitive benchmarking, on the other hand, assesses your performance against direct competitors, giving you a clear picture of where you stand in the market. Lastly, best-in-class benchmarking focuses on studying industry leaders, even if they’re not competitors, to learn from their practices and achieve outstanding results.

Choosing the right approach depends on your goals. If your focus is on refining internal processes, internal benchmarking is a great starting point. Want to gauge your market position? Competitive benchmarking is the way to go. And if you're aiming for breakthrough performance, best-in-class benchmarking can provide the inspiration you need. Match the method to your business priorities and available resources to get the most out of your efforts.

How do seasonal trends and regional differences affect eCommerce KPIs, and how can businesses adjust their benchmarks accordingly?

Seasonal patterns and regional variations play a big role in shaping eCommerce KPIs, impacting key metrics such as sales, conversion rates, and customer behavior. For instance, holiday shopping periods or region-specific celebrations often lead to noticeable shifts in performance.

To set realistic benchmarks, businesses need to dive deep into their data and factor in these influences. Tools like Querio simplify this process by enabling teams to analyze real-time data directly from platforms like Snowflake or BigQuery. By leveraging natural language processing, users can pose specific questions and quickly gain insights, ensuring their benchmarks align with the unique challenges and opportunities of seasonal and regional trends.