Ask Querio: The NLP Upgrade Your CFO Will Thank You For

Business Intelligence

Jul 9, 2025

Transform financial reporting and forecasting with natural language processing that simplifies insights and enhances decision-making for CFOs.

CFOs are under pressure to make fast, data-driven decisions, but outdated tools and manual processes slow them down. Querio solves this problem with natural language processing (NLP) that turns plain questions into instant financial insights.

Here’s how Querio helps finance teams:

Instant Reports: Skip complex SQL queries. Just ask questions like, “What’s our cash flow projection?” and get clear, real-time answers.

Dynamic Dashboards: Build live, auto-updating dashboards without technical skills.

Automation: Free up time by automating data extraction, categorization, and compliance checks.

Accurate Forecasting: Use live data and consistent metrics to improve predictions.

Security and Compliance: SOC 2 Type II certification, encryption, and privacy compliance ensure data safety.

Affordable Access: Share insights across teams with unlimited viewers for $14,000/year.

Querio empowers CFOs to focus on strategy by simplifying financial reporting and automating routine tasks. It’s a smarter, faster way to manage and analyze financial data.

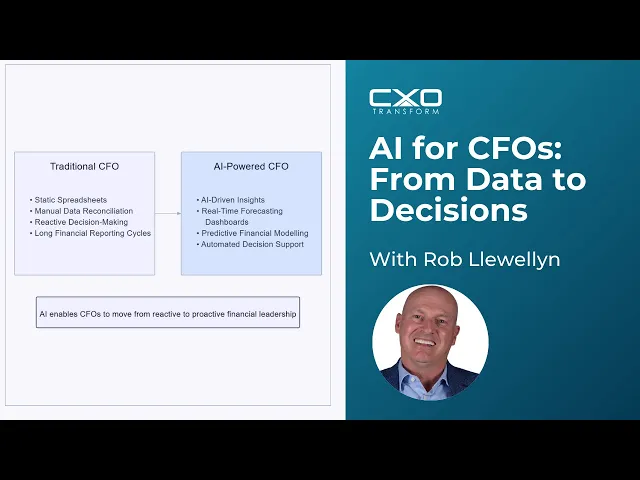

AI for CFOs: How to Use AI for Financial Strategy & Decision-Making

Making Financial Reports Easier with Querio's NLP

Say goodbye to wrestling with complex SQL queries just to uncover financial insights. Querio's natural language processing (NLP) is changing the game for CFOs and finance teams by turning plain English questions into instant, accurate reports. This approach tackles a major issue in finance: 89% of CFOs admit to making decisions based on inaccurate data [2]. Traditional methods often fall short, delaying the insights that finance leaders need.

Querio’s AI-powered platform removes technical roadblocks. It connects directly to live data warehouses like Snowflake, BigQuery, and Postgres, allowing users to ask questions in everyday language and receive clear, visualized answers in seconds.

The benefits for decision-making are clear. Companies that rely on data are 19 times more likely to be profitable [4]. Additionally, 84% of CFOs believe real-time analytics improve decision-making [4]. Querio bridges the gap by making data accessible to finance teams, no matter their technical expertise. Let’s explore how Querio simplifies financial reporting and dashboard creation for finance teams.

Creating Custom Financial Reports Automatically

Querio makes crafting financial reports as easy as having a conversation. CFOs can simply ask, “What are the quarterly revenue trends by product line?” or “What’s our cash flow projection for the next six months?” and receive tailored reports instantly.

The platform’s AI agent converts these natural language requests into precise SQL queries, securely pulling data from live warehouses. This real-time access enables CFOs to make quick, well-informed decisions [3], cutting out the delays of traditional monthly reporting cycles.

Finance teams can generate detailed reports, from P&L statements to budget variance analyses, without needing technical skills. A built-in context layer ensures data governance by enforcing consistent business definitions and relationships, so every report reflects accurate and standardized metrics.

Building Dashboards Quickly for Live Data

Creating dashboards is effortless with Querio’s intuitive drag-and-drop interface, designed specifically for finance professionals. These dashboards consolidate essential financial data into visual snapshots of company performance [3]. Querio ensures that anyone on the finance team can build and update dashboards with ease.

Because the platform connects to live data, dashboards update automatically, replacing static reports that can quickly become outdated. This shift from static to dynamic reporting transforms financial operations, enabling daily insights rather than reactive monthly reviews. CFOs can identify potential problems early and take action before they escalate [2].

Companies leveraging real-time analytics report productivity gains of up to 20% and profit margins up to 5% higher [4]. Querio’s dashboards enhance performance by helping CFOs model scenarios and evaluate investment opportunities with precision [2]. Automated alerts for key financial thresholds ensure that critical metrics are always on the radar.

Querio’s collaborative dashboard features allow CFOs to share insights instantly with executives and board members, keeping everyone informed without requiring extra technical resources. With unlimited viewer access, organizations can make financial data more accessible while maintaining security and governance controls.

Working Faster with Automated Data Extraction

Automated data extraction is revolutionizing financial reporting by turning tedious tasks into opportunities for strategic improvement. For many finance teams, manual data extraction is a bottleneck. CFOs often see analysts spending countless hours copying data from spreadsheets, categorizing expenses, and processing invoices - time that could be better spent on strategic financial planning. Querio's NLP automation flips this script, taking over repetitive tasks and allowing teams to focus on high-value work.

The impact of automation is striking. Many companies report cutting data entry costs by 50–80% after adopting NLP bookkeeping systems [6]. These systems not only reduce costs but also free up talent for critical tasks like analysis and forecasting.

Querio’s automated extraction integrates seamlessly with your data warehouse, pulling and organizing information in real time. It categorizes transactions, extracts essential details from financial documents, and applies your business rules - all while minimizing errors and maintaining consistency across records.

Traditional methods rely on finance staff manually reviewing documents, entering data, and double-checking for accuracy - a process prone to mistakes and inefficiencies. Automated systems, however, offer a clear edge. For instance, recent studies reveal that GPT-4 achieved a 60.31% accuracy rate in financial statement analysis, outperforming human analysts at 56.7% [7]. This level of precision underscores the practical benefits of automation.

Take JPMorgan Chase as an example. By implementing the COiN platform, which uses machine learning to review commercial loan agreements, the bank reduced a process that used to take thousands of hours to mere seconds. Accuracy improved, and employees were freed to tackle more meaningful work [8]. While JPMorgan operates on a massive scale, the principle applies universally: automation drives efficiency and enables finance teams to focus on strategic initiatives.

Moving Staff to Important Projects

Automation doesn’t just save time - it transforms how finance teams operate. By offloading routine data entry, staff can shift their focus to analyzing trends, modeling scenarios, and uncovering cost-saving opportunities. This shift enhances their role as strategic business partners, helping optimize cash flow and deepen insights into overall performance.

Automated compliance checks are another game-changer, improving accuracy and freeing up resources [7]. With these tasks handled, finance teams can move beyond reactive compliance to proactive risk management and strategic planning. Querio’s NLP tools empower CFOs to lead this shift, enabling smarter financial planning. However, this transformation requires careful change management. CFOs should prioritize training programs to help their teams adopt AI tools, interpret results, and seamlessly integrate new workflows [8].

Stripe CEO Patrick Collison sums up the potential of automation perfectly:

"We live in an era where automation and technology can get us highly efficient and effective financial systems that serve businesses and customers better than ever before." [5]

Querio brings this vision to life for finance teams, turning routine data tasks into opportunities for strategic growth through smart automation.

Better Financial Forecasting with AI

With the rise of automated data extraction and real-time dashboards, financial forecasting has shifted from being a reactive process to a proactive tool for CFOs. Traditional methods often struggle to keep up with the complexities of today’s data, but Querio's NLP technology changes the game by turning vast amounts of unstructured text into actionable insights [1]. By automating core forecasting tasks, NLP ensures consistent, real-time insights, freeing CFOs from manual data collection and allowing them to focus on strategic decision-making. This streamlined approach spans the entire forecasting process - defining goals, selecting time frames, collecting and analyzing data, choosing methods, creating pro forma statements, and documenting results [9]. The integration of advanced analytics now enables more precise and controlled forecasting.

Controlled Metrics for Accurate Forecasts

Accurate financial forecasting hinges on the use of standardized metrics. Querio's context layer tackles this by ensuring consistent business definitions across all forecasting activities. This consistency covers critical areas like revenue recognition, expense classification, and key performance indicators, so every department operates with the same understanding.

The context layer simplifies governance by letting data teams define table joins, business metrics, and glossary terms once, which are then applied organization-wide. Querio’s NLP leverages these definitions to deliver reliable forecasts, whether analyzing revenue trends or tracking expense patterns. This eliminates confusion caused by inconsistent definitions across departments.

NLP also improves data analysis accuracy by identifying trends, spotting risks, and processing large datasets with precision [1]. For instance, when forecasting quarterly revenue, Querio can evaluate historical sales data, contract terms, market sentiment from earnings reports, and seasonal trends - all while adhering to your organization’s specific rules and definitions.

Additionally, NLP enhances forecasting by incorporating sentiment analysis. This feature interprets the tone and sentiment of text, helping financial institutions gauge market trends, investor attitudes, and public perception [1]. By adding this qualitative layer to traditional quantitative models, organizations gain a more comprehensive understanding of their financial landscape.

Planning Ahead with Live Data Access

Standardized metrics lay the foundation for accurate forecasts, but real-time data access takes it further. By integrating live data into forecasting, organizations can base decisions on the most current insights available. Querio connects directly to platforms like Snowflake, BigQuery, and Postgres without duplicating data, ensuring forecasts reflect up-to-date information. This capability allows CFOs to identify risks and opportunities as they arise, rather than discovering them weeks later in scheduled reports.

Querio’s NLP processes large datasets in real time [1], scaling effortlessly as your business grows. Whether projecting daily cash flow or planning multi-year strategies, the platform maintains its performance without slowing down.

A practical example of this is Project Alfred, an accounting firm using Xero. By integrating HubSpot and Xero data, they eliminated manual data exports and improved revenue forecasting. This connection between sales pipeline data and historical financial performance enabled more accurate projections [9].

The ability to query data in plain English makes these tools accessible to finance teams without technical expertise. For example, a CFO could ask, “What’s our projected cash flow if Q4 sales drop by 15%?” and instantly receive clear visualizations based on the latest data. This immediacy supports proactive financial management, enabling teams to respond swiftly to challenges.

Real-time anomaly detection further sharpens forecasting accuracy. In December 2024, Align Technologies reduced audit preparation time by 80% and identified risks across billions of SAP transactions using MindBridge’s AI-driven anomaly detection platform (Source: MindBridge, 2024). This technology highlights unusual patterns, helping organizations address potential forecast risks or seize emerging opportunities before they fully develop.

Meeting Compliance and Growth Needs for Finance Teams

Finance teams face a dual challenge: harnessing AI-driven analytics while ensuring strict compliance with regulatory standards. With nearly 20% of financial firms targeted by cyberattacks and 84% of affected organizations experiencing at least one breach [11], robust security is non-negotiable. Querio steps in with enterprise-grade security and scalable features, designed to meet the needs of growing finance teams. By addressing compliance concerns head-on, Querio empowers CFOs to use advanced analytics without compromising security. Let’s dive into the details of its security framework.

Data Control and Security

Protecting financial data requires a comprehensive framework that addresses every aspect of data handling. Querio meets this need by achieving SOC 2 Type II compliance, which ensures strict controls for security, availability, and confidentiality [10].

"At Querio, your data's integrity is our top priority. We bring together advanced technology, comprehensive policies, and a team dedicated to security to ensure your data remains protected." [10]

The platform employs AES-256 encryption to secure data at rest and HTTPS/TLS 1.3 for data in transit [10]. By leveraging Amazon Web Services (AWS) for its cloud hosting, Querio benefits from one of the most secure infrastructures available [10].

To minimize risks, Querio uses role-based access control with minimal permission settings [10]. This means team members can only access the specific data and features necessary for their roles, reducing the likelihood of unauthorized data exposure. Connection details are stored as hashed values, and the platform supports read-only connections to prevent unintended data modifications [10].

Querio also complies with major privacy regulations, including CCPA and GDPR, and signs a Data Processing Agreement (DPA) during onboarding [10]. Considering that non-compliance with GDPR can result in fines of up to $20 million or 4% of global revenue [11], this proactive approach helps organizations avoid costly penalties.

Security is maintained through continuous monitoring. Querio regularly audits its architecture, codebase, and logs, ensuring vulnerabilities are identified and addressed promptly [10]. The company also enforces rigorous security policies, software development standards, and two-factor authentication (2FA) requirements [10].

For organizations with stringent data residency requirements, Querio offers on-premise deployment options with temporary data storage in a secure virtual private cloud (VPC) [10]. This setup ensures both compliance and flexibility, making the platform suitable for even the most regulated environments.

Growing with Unlimited User Access

Traditional analytics platforms often limit growth by charging per-user fees, which can quickly escalate costs as teams expand. Querio eliminates this barrier by offering unlimited viewer access, allowing finance teams to share data freely without worrying about additional expenses.

This model is especially useful for teams that need to share insights across departments. Whether it’s presenting quarterly results to the board, sharing budget updates with department heads, or providing real-time dashboards to operational teams, finance leaders can grant access without stretching their budgets. Querio’s pricing includes a $14,000 annual core fee for unlimited viewers, with optional add-ons like dashboards ($6,000 per year) and extra database connections ($4,000 per database per year) [10].

The platform’s tiered feature structure is designed to accommodate different user needs. Viewers can access dashboards and reports, while power users have tools for creating custom analyses and managing data governance. This ensures organizations only pay for advanced features when needed, while still providing broad access to essential financial insights.

Querio’s drag-and-drop dashboard tools make it easy for finance teams to track KPIs and build compelling visualizations without requiring technical expertise [10]. As businesses grow into new markets or add business units, teams can quickly adapt their reporting and analysis capabilities to meet new demands.

With a 99.9% uptime SLA [10], Querio ensures consistent access to critical financial data. This reliability becomes even more important as teams expand and more users depend on the platform for daily decision-making and reporting.

Conclusion: Why CFOs Need Querio's NLP Upgrade

The financial world is evolving rapidly, and CFOs who embrace AI-powered analytics are positioning themselves ahead of the curve. With 96% of CFOs prioritizing AI integration [14] and 90% planning to increase AI budgets in 2024 [12], the real question is: how soon can they implement NLP solutions?

Querio's NLP upgrade delivers tangible benefits. For instance, 58% of organizations report major cost reductions [12] by automating manual tasks and enabling teams to focus on strategic initiatives. Beyond efficiency, this shift bolsters data security and compliance - vital concerns in today’s financial environment.

Security remains a top priority, with 76% of financial leaders expressing concerns [14]. Querio addresses this head-on with SOC 2 Type II compliance and advanced encryption, ensuring data integrity and regulatory adherence. These measures, discussed earlier, are designed to meet the highest security standards.

For CFOs, aligning AI strategies with business goals and emphasizing strong data governance is critical [13]. Querio simplifies this process with its natural language interface, making AI adoption accessible even for non-technical users. By integrating Querio, CFOs gain a toolset that enhances efficiency, strengthens security, and delivers actionable insights - key components for navigating modern finance.

Querio also eliminates cost barriers with its unlimited viewer access model. At $14,000 annually for the core platform, it offers broad team access, with optional add-ons for dashboards and additional connections.

AI’s ability to uncover hidden patterns and correlations within data can reveal opportunities or mitigate risks that might otherwise go unnoticed [13]. Querio’s NLP upgrade isn’t just about streamlining processes - it’s about unlocking insights that lead to smarter financial decisions and a stronger competitive edge.

For CFOs ready to revolutionize their financial operations, the journey starts with robust cybersecurity to safeguard sensitive data [13] and fostering continuous learning to enhance team capabilities [13]. Querio offers the technology and security framework needed to make this transformation a reality.

FAQs

How does Querio's NLP technology make financial forecasting more accurate and efficient?

Querio uses advanced NLP technology to transform financial forecasting. By automating the extraction and analysis of massive amounts of unstructured financial data, it minimizes human error and removes biases that often creep into manual processes.

What sets Querio apart is its ability to deliver real-time insights. It identifies critical events and trends as they unfold, allowing for faster and more accurate predictions. Unlike traditional methods that depend on fixed models, Querio’s dynamic system adjusts to evolving data, equipping CFOs with the tools they need to make smarter, more strategic decisions.

What security measures does Querio use to protect data and comply with regulations like GDPR and CCPA?

Querio places a high priority on data security and regulatory compliance. The platform holds a SOC 2 Type II certification and complies fully with privacy laws such as GDPR and CCPA. To safeguard your data, Querio conducts regular security audits, performs vulnerability tests, and continuously monitors its systems.

The platform also employs strict data minimization practices, ensuring that only the essential information is processed. By emphasizing confidentiality, integrity, and compliance, Querio is built to meet rigorous security and privacy standards, offering reassurance when managing sensitive financial data.

How does Querio's automation help finance teams focus on strategic priorities instead of routine tasks?

Querio takes the hassle out of routine tasks by leveraging natural language processing (NLP). This means finance teams can simply ask questions and get instant insights - no need for technical know-how or tedious manual data handling. Tasks like generating reports or pulling data become quick and effortless, saving valuable time.

The platform’s real-time dashboards keep teams up to date with the latest information automatically. This allows them to focus on more important priorities like financial planning, forecasting, and making strategic decisions. By simplifying workflows, Querio helps finance professionals dedicate their energy to initiatives that drive business growth.